India is emerging as an oasis in a turbulent world - NSE MD & CEO Ashishkumar Chauhan

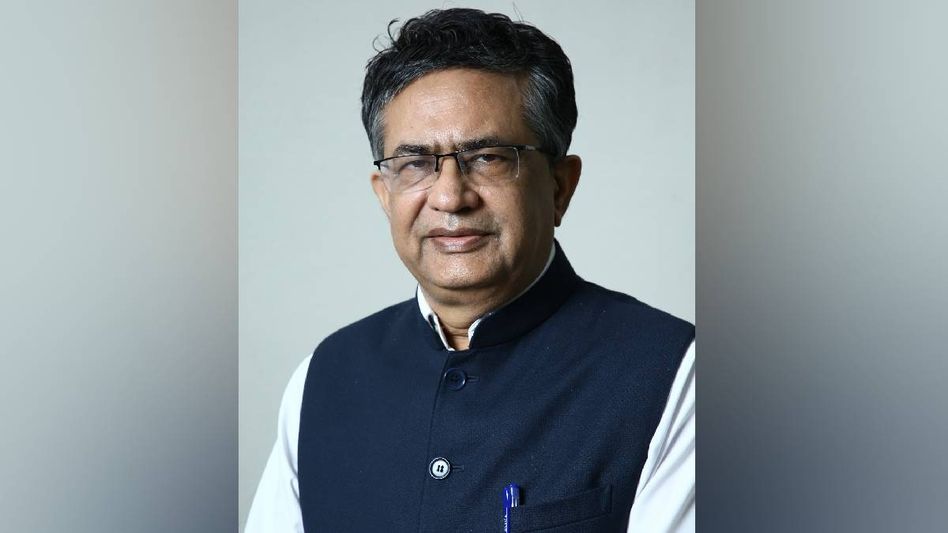

Amid mounting global economic uncertainty, India stands out as a resilient and rapidly growing market, according to Shri Ashishkumar Chauhan, Managing Director and CEO of the National Stock Exchange of India (NSE)

Amid mounting global economic uncertainty, India stands out as a resilient and rapidly growing market, according to Shri Ashishkumar Chauhan, Managing Director and CEO of the National Stock Exchange of India (NSE). Speaking at the India Global Forum – Mumbai NXT25, Chauhan delivered a comprehensive assessment of India's market trajectory, investor participation, and evolving capital market dynamics.

Despite a temporary dip of $1.5 trillion from its peak valuation, Chauhan highlighted India's remarkable long-term capital market growth. “India’s market capitalisation was under $1 trillion in 2014. Today, we are approaching the $5 trillion mark, reflecting extraordinary wealth creation,” he said.

Addressing foreign investor concerns, Chauhan pointed to global interest rate hikes and a general ‘risk-off’ sentiment affecting emerging markets. However, he underlined India’s unique positioning due to its diversified export profile, which provides a level of insulation from international trade tensions.

Retail investors continue to play a pivotal role in India’s market resilience. With over 60 million individuals contributing as little as ₹250 monthly through Systematic Investment Plans (SIPs), domestic flows amount to a steady $2.5–3 billion per month. “This consistent retail inflow is a sign of increasing public confidence in Indian businesses and entrepreneurial potential,” Chauhan stated.

In terms of financial inclusion, Chauhan noted that small-ticket direct investments are fostering deeper market engagement. “Even amid market volatility, investors are showing maturity by continuing regular investments. It marks a paradigm shift in India’s retail investment behavior,” he added.

India’s IPO landscape remains active, with more than 50 new filings recorded in late March. In 2024 alone, NSE facilitated 268 IPOs — including 178 from small and medium enterprises (SMEs) — raising a total of $19.6 billion. This figure marked the highest IPO fundraising globally for the year. Overall capital mobilisation on the NSE surpassed $209 billion.

Chauhan also addressed recent operational updates, particularly the shift in derivatives expiry from Thursday to Monday, attributing the move to regulatory directions and market-wide consultations. “It’s a procedural change, and we await further guidance before implementing additional transitions,” he clarified.

In closing, Chauhan emphasised India's strong economic fundamentals, asserting that the country remains a source of stability amid global financial turbulence. “Our regulatory framework and governance are steady, and India is cautiously navigating these uncertain times,” he concluded.

Copyright©2025 Living Media India Limited. For reprint rights: Syndications Today