Union Minister Nitin Gadkari clears air on reports of extra 10% GST on diesel cars, says 'no such proposals'

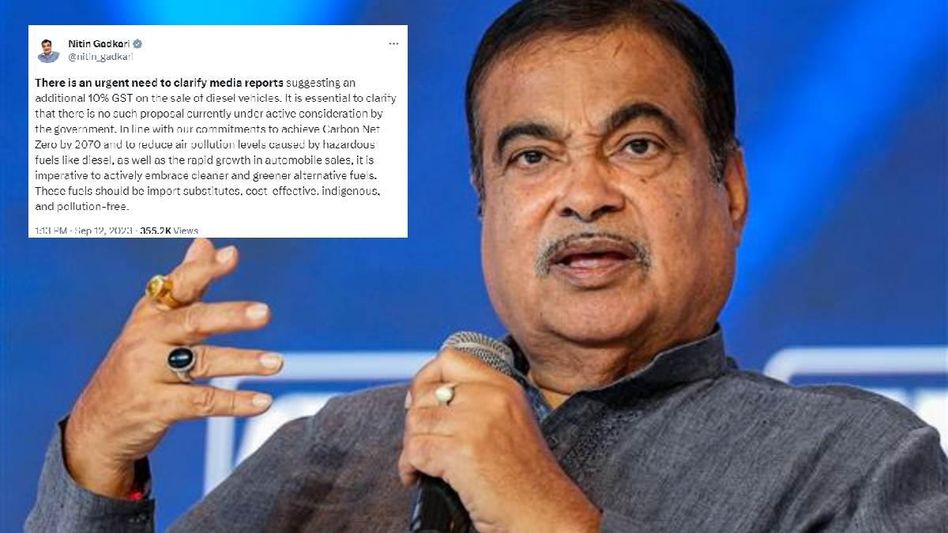

"There is an urgent need to clarify media reports suggesting an additional 10% GST on the sale of diesel vehicles. It is essential to clarify that there is no such proposal currently under active consideration by the government".

Union Minister Nitin Gadkari clears air on reports of extra 10% GST on diesel cars, says 'no such proposals'

Union Minister Nitin Gadkari clears air on reports of extra 10% GST on diesel cars, says 'no such proposals'Nitin Gadkari, the Union Minister for Road Transport & Highways, refuted media claims that he was about to impose a 10% extra GST on the purchase of diesel automobiles.

"There is an urgent need to clarify media reports suggesting an additional 10% GST on the sale of diesel vehicles. It is essential to clarify that there is no such proposal currently under active consideration by the government", wrote Nitin Gadkari in a Twitter post.

"In line with our commitments to achieve Carbon Net Zero by 2070 and to reduce air pollution levels caused by hazardous fuels like diesel, as well as the rapid growth in automobile sales, it is imperative to actively embrace cleaner and greener alternative fuels. These fuels should be import substitutes, cost-effective, indigenous, and pollution-free", he added.

There is an urgent need to clarify media reports suggesting an additional 10% GST on the sale of diesel vehicles. It is essential to clarify that there is no such proposal currently under active consideration by the government. In line with our commitments to achieve Carbon Net…

— Nitin Gadkari (@nitin_gadkari) September 12, 2023

It was previously reported that the minister was prepared to suggest an extra 10% GST on the purchase of diesel vehicles in India. Gadkari allegedly warned automakers that if they continue to sell extremely polluting automobiles, charges may be further increased.

"Say bye to diesel soon, otherwise we will increase so much tax that it will become difficult for you to sell these vehicles ... we have to leave petrol and diesel soon and walk on the new path of being pollution free," Gadkari was quoted according to several reports.

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today